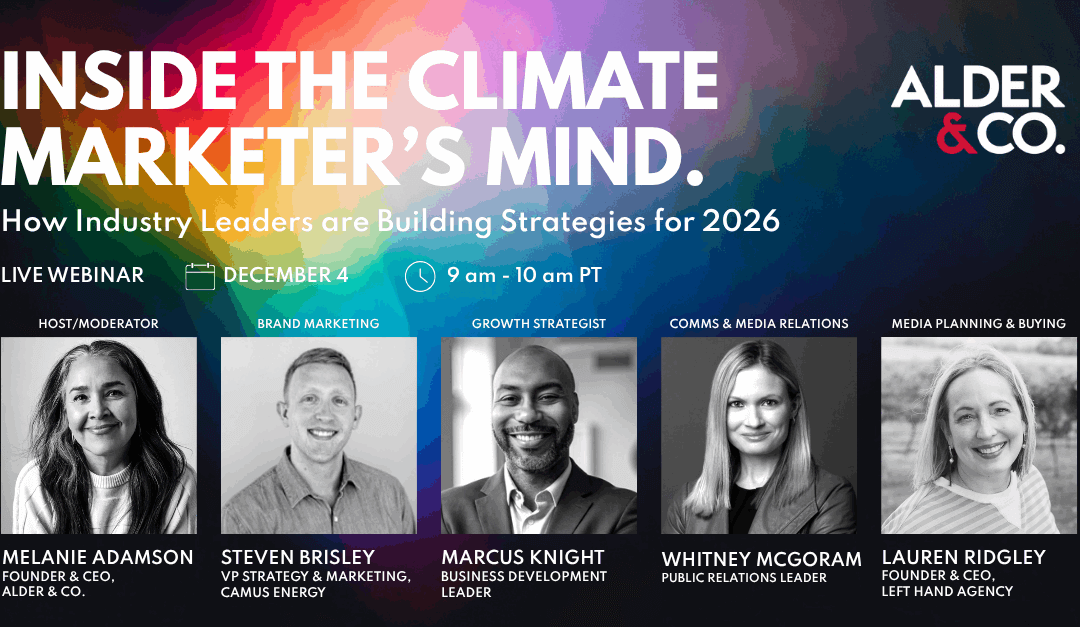

Hosted by CurvePoint Capital and Alder & Co., this Pacific Northwest Climate Week panel wasn’t your typical “rah-rah” entrepreneur session. It was real talk about what it actually takes to grow and fund a business as a female founder, minus the fluff. These are stories that made you nod along, about hard-won lessons, and advice you can actually use the next time you’re in front of an investor or navigating the rollercoaster of entrepreneurship.

A few big takeaways:

Fundraising and Pitching, AKA “Reading the Room”

The panelists made it clear: your pitch has to be tailored to the investor. Numbers and trajectory matter more than just impact, and you need to know what problem the investor already cares about. Also? Own your expertise. As Jackie Lou Raquidan, Chief Growth Officer, 5T Wealth put it:

“When you walk into a room and a man is there pitching his business, good chance he’ll win the pitch over a woman. But, statistically when you talk about the great wealth transfer, that’s going to be controlled by women. So we definitely need more women investors that are going to be writing checks that’s catered to women only, just because the ratio is so off.”

Find Investors Aligned With Your Vision

Don’t waste time trying to change minds—find alignment. Alena Solonina, investor, CurvePoint Capital nailed it:

“When you’re fundraising, I think it’s very important to find an investor who you’re not changing their view or opinion on a specific solution. You need to find someone who is already aware of this solution. So you’re finding the alignment because if you’re trying to change someone’s opinion in that room, that’s a fail from day one.”

Family Offices = Quarterbacks

Jackie Lou explained that family offices can do way more than write a check. They’re the behind-the-scenes strategists who help with estate planning, tax strategy, philanthropic oversight and even matchmake founders with aligned ultra-high-net-worth investors.

“Family offices can be used as more of a quarterback … whether you are actually raising capital, or during, or post-liquidation, having that alignment with a wealth advisor or a family office with your attorney, with your CPA…that coordinated team approach is critical,” Jackie Lou says.

Failure Isn’t Fatal—It’s a Data Point

The panelists reminded everyone that mistakes = growth. Alena put it bluntly:

“I learned from failures more than from successes. I’ve been investing for over a decade… I did lose money… and I learned the most from those deals, like what was wrong: was it the team, was it the business plan, what should I do differently next time?”

Balance? Nah—Efficiency

Forget perfect work-life balance; it’s about efficiency. Nicole Carr, CFO, Circuit shared how she “speed dates” investors:

“You’re not going to say no to introductions. You’re not going to say no to calls, but you have to be really efficient with your time, understanding quickly if a second call is warranted and if you’re going to move forward with another conversation.”

Urgency vs. Missing Out

Creating urgency for investors to “close next week” rarely works. Building a little FOMO does. Shrina Kurani, Managing Partner, SnoCap told us:

“You can create a sense of urgency, but it often just doesn’t really work for investors. You have to create a sense of scarcity as opposed to a sense of urgency.”

Ensuring a Good Portfolio Fit

Lead investors aren’t just the biggest check writers—they set the tone and validate your company for others. It’s important that your company is a good fit and complement to the broader portfolio.

Winning vs. Being Right

As leaders, you have to know when to push and when to let go. Shrina summed it up perfectly: she often wants to “be right” in heated discussions with male partners but draws the line if “winning” means making a compromise she’ll regret later.

Bottom line: this wasn’t a panel about motivational quotes and shiny success stories. It was about how to play the game and win it, on your terms.

Need help? There’s an AI tool (or a marketer like Alder) ready to back you up. Email us your questions at [email protected].

Need help? There’s an AI tool (or a marketer like Alder) ready to back you up. Email us your questions at [email protected].

Written by

Melanie Adamson

Melanie has worked tirelessly for over twenty years to shape marketing strategies and storytelling for energy and climate tech. She is passionate about making climate technologies universal while ensuring climate justice for all, which drives her leadership, innovation and mentorship. Mel envisions using Alder and Tofu as a platform to extend the climate message, activate complacent norms, and influence a new generation of climate heroes. When Mel isn’t running Alder, she loves cooking for family and friends, and sharing stories with a glass of French or Spanish red wine.