U.S. funding remains stable thanks to grant funding; Europe sees significant decrease

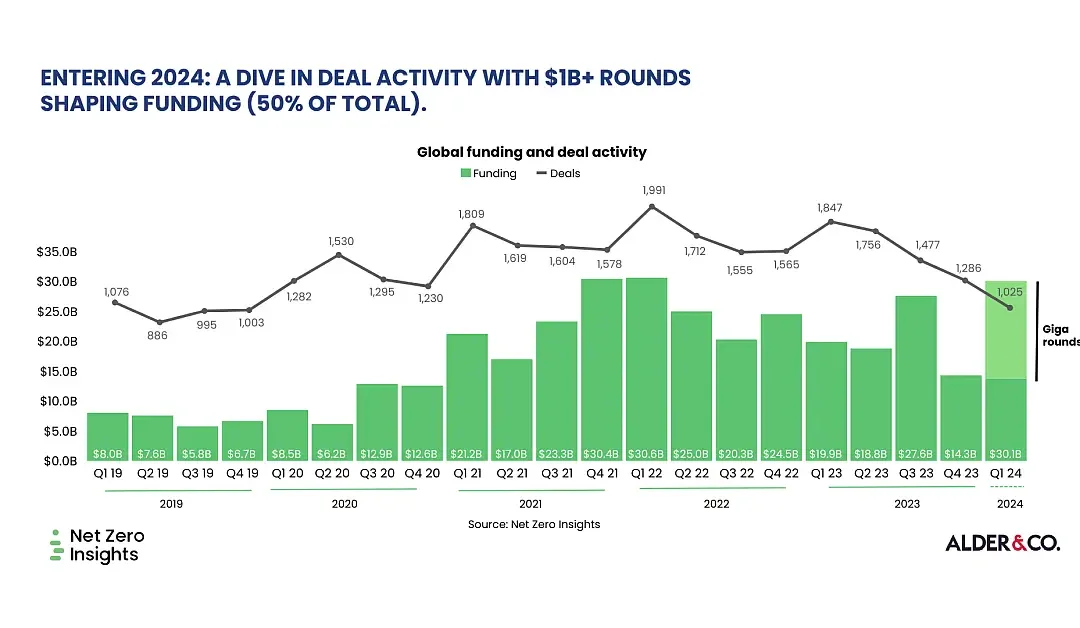

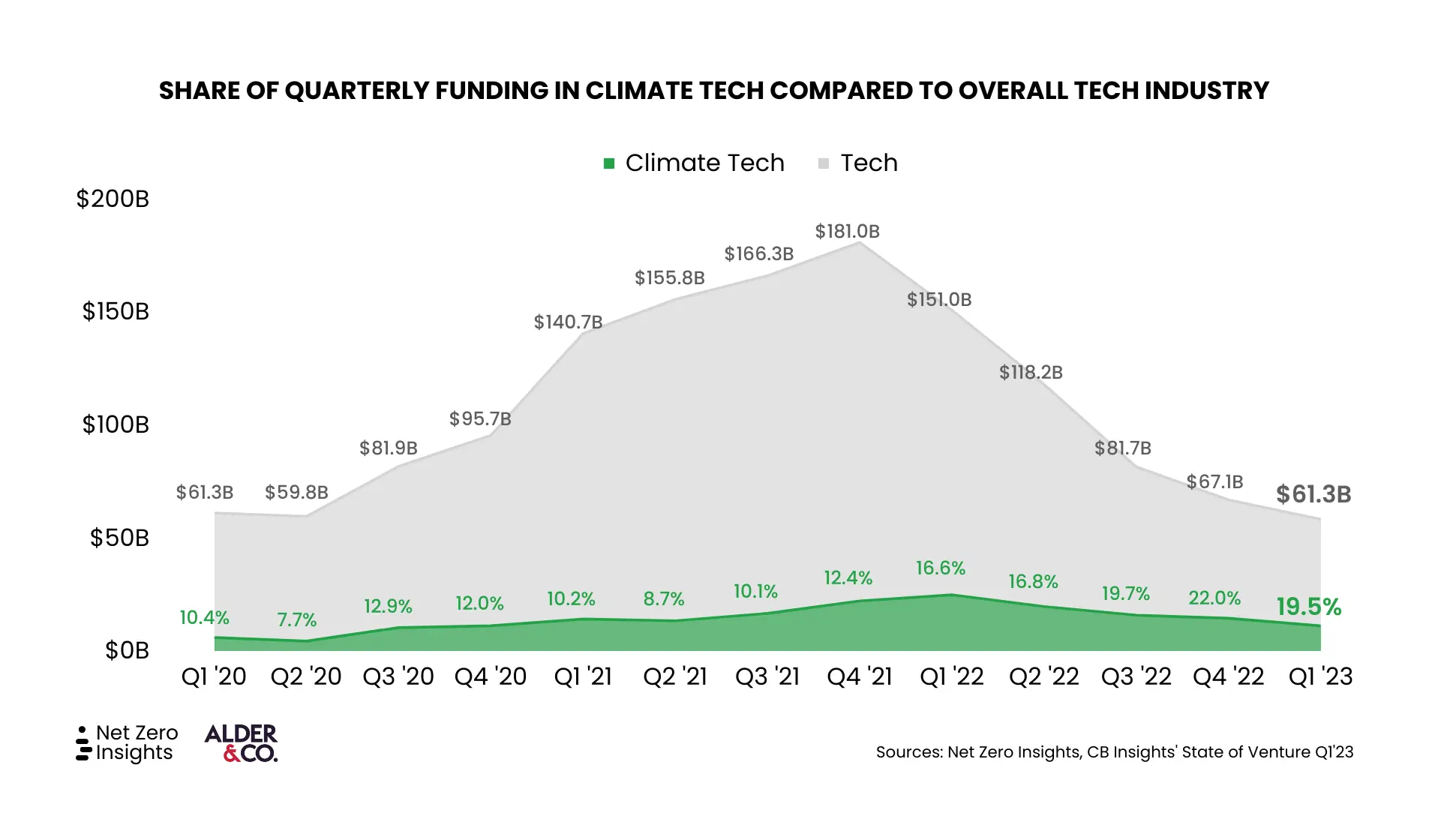

LONDON/PORTLAND, Ore. – April 19, 2023 – Net Zero Insights, the leading market intelligence platform for climate tech in Europe and North America, together with Alder & Co., a purpose-driven climate tech marketing agency, today announced Q1 climate tech investment results demonstrating an overall slowdown. However, nearly 20% of funding in venture tech overall went specifically to climate, showcasing the industry’s resiliency. Total European investment was $4.4B (down 58% from Q4 2022), and total U.S. investment came in at $9.0B (down 7% from Q4 2022).

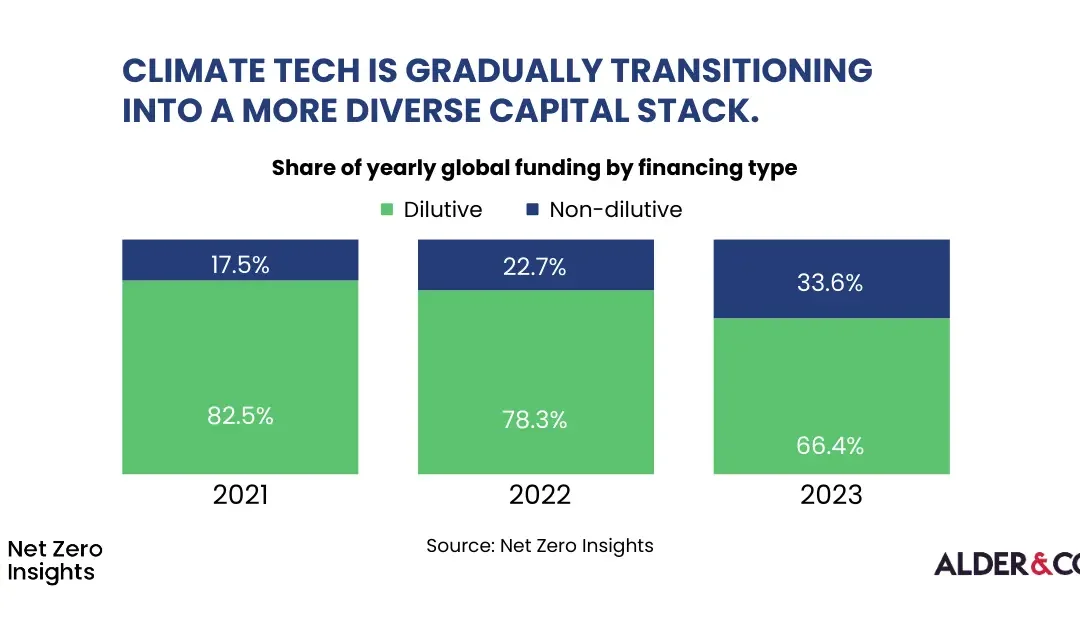

Non-equity sources provided 42% of the total $14.5B in funding this quarter with major deals including Redwood Materials ($2B), Zenobe Energy (£235M), Raylo (£110M), Blocpower ($130M) and Onto (£100M). Grant funding also rose 20% over the previous quarter in part due to the momentum from the passage of the U.S. Inflation Reduction Act and progress on the European Green Deal.

“While the EU continues to work through the details of its own Green New Deal, we are seeing more European companies eyeing opportunities in the U.S. to take advantage of the momentum derived from the IRA”, says Melanie Adamson, chief marketing strategist, Alder & Co.

“Investors are increasingly focused on funding startups and organizations that demonstrate a clear path to profitability.”

While the share of debt increased in relation to the total funding, the absolute volume of debt funding actually decreased quarter over quarter. Nevertheless, the amount of debt raised in Q1’23 is still significantly above the 2021 quarterly average of $3.1B. Equity investment, currently $8.5B, has consistently decreased since it hit $23.3B in Q1’22.

“Investors are increasingly focused on funding startups and organizations that demonstrate a clear path to profitability,” said Federico Cristoforoni, co-founder, Net Zero Insights. “This underscores the need for climate tech companies to develop sustainable business models that balance growth with financial stability.”

Of the ten challenge areas analyzed, only the circular economy vertical raised more quarter-over-quarter funding. More than 40% of total funding went to the energy sector, maintaining momentum in the global transition to electric vehicles, solar and other renewable sources.

“Silicon Valley Bank’s collapse….. may have had a net positive effect: diversification.”

While Silicon Valley Bank’s collapse rattled climate tech startups and sent shockwaves through U.S. investment communities, it may have had a net positive effect: diversification.

What we learned from the SVB fallout is that the banking system and the ways in which finance is directed into sustainable investment has to change,” said Jon Shieber, chief editor and venture partner at Footprint Coalition. “Luckily, more regional and community banks are waiting in the wings.”

Net Zero’s reporting uses data from Net0 platform to analyze funding for climate tech startups, scaleups and SMEs, mainly in Europe and North America. The analysis covers funding activity from January 2021, excluding certain round types such as acquisition, IPO and SPAC.

Read the full report.

About Net Zero Insights

Net Zero Insights operates the Net0 Platform – today probably the most comprehensive database of climate tech startups and SMEs operating in Europe and North America. Investors, corporates and decision-makers work with us to gain insight into financial and tech trends by accessing data on funding rounds, activity sectors, technology, patents, contact details, and much more. Find out more: netzeroinsights.com

About Alder & Co.

Alder & Co. is a leading, global strategic brand marketing agency with the mission to drive the adoption of climate technologies until they become universal. Alder partners with forward-facing, innovative climate tech companies who need progressive brand & marketing strategies to drive growth, secure investment and make the impact needed to address our generation’s most urgent crisis – our environment. Find out more: alderagency.com

Media Contact

Whitney McGoram, [email protected]