New report structure features breakdowns by product innovation framework, deal stage, and stakeholder perspectives; offering unparalleled analysis

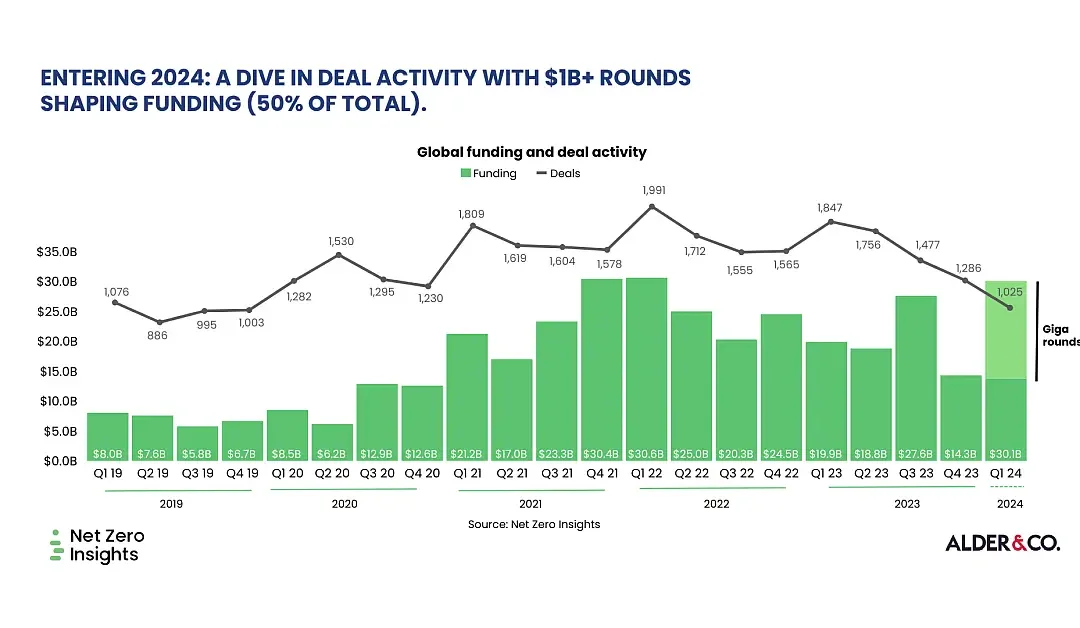

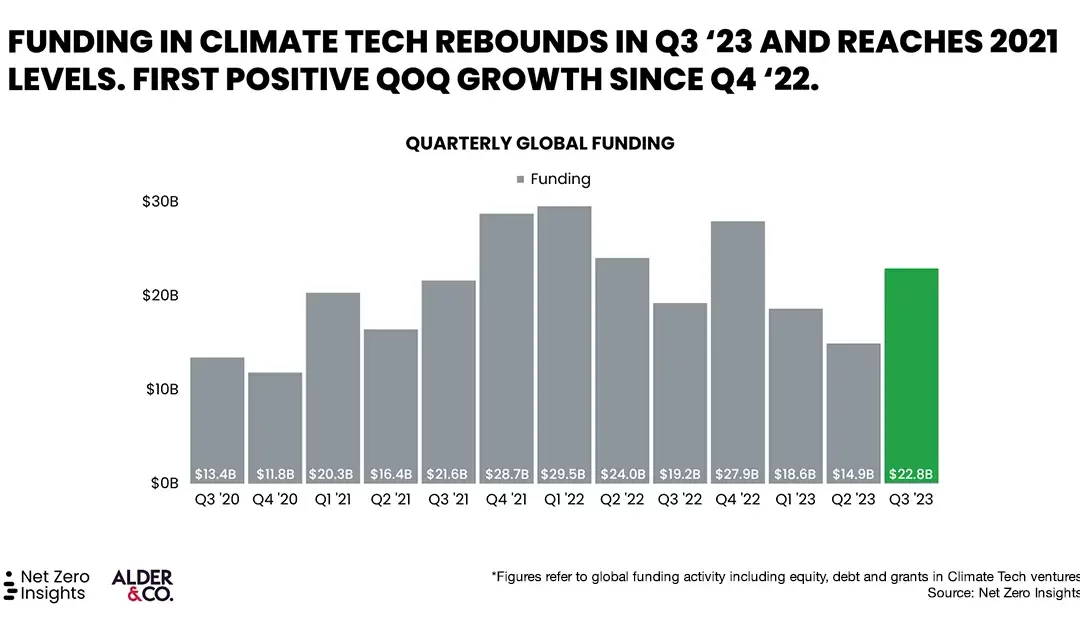

LISBON/PORTLAND, Ore. — January 18, 2024 — Today Net Zero Insights, the leading market intelligence platform for climate tech, supported by Alder & Co., a purpose-driven climate tech marketing agency, released its annual analysis on global funding and deal activity in the private market and ventures space: State of Climate Tech 2023. While the comprehensive report shows a 30 percent year over year (YoY) global funding drop for the sector, several key takeaways from the data point toward a brighter year ahead.

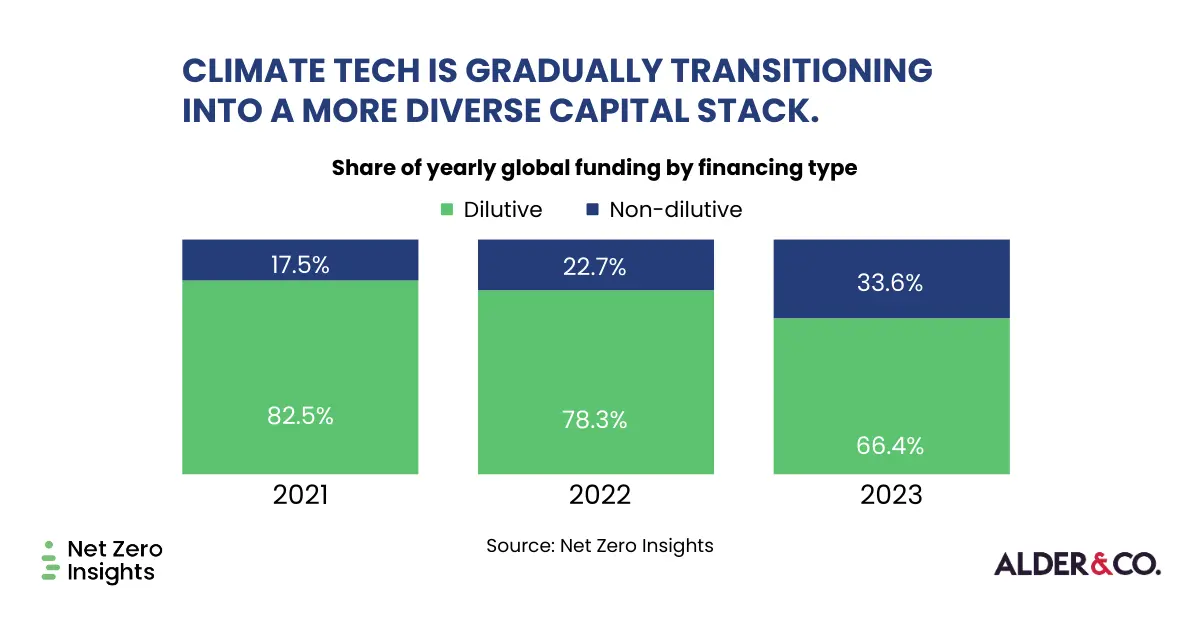

Steady Rise of Non-Dilutive Funding

As equity investment took the strongest hit (-40 percent YoY), resourceful entrepreneurs turned their attention to public funding opportunities and alternatives, driving non-equity funding for climate tech to a historic high of 34 percent. “The diversification in financing approaches we’re seeing tells a story of a growing maturity within the market,” said Federico Cristoforoni, Co-Founder, Net Zero Insights. “More banks and governments invested in later stage climate tech in 2023 than in 2022.”

A big F-O-A-K ing Year

First of a kind projects (FOAK) entail a financing approach that addresses the risk of a project, which is generally too capital intensive for VCs and too novel for PE/ infrastructure finance. So while there continues to be a valley of death for mid-stage FOAK start ups due to the risk involved in commercialization, later-stage investors and lenders seem increasingly prepared to support readily deployable physical solutions. The 10 illustrative FOAK deals featured in the report involved solutions from E-Fuels to Batteries.

“What is very exciting to us is that there is not one single initiative or source of finance that we see trying to enhance FOAK finance, but several,” said Chetan Krishna, Head of Research and Diligence at Third Derivative who is featured in the report. “The spectrum of players is vast and as H2GS’s Boden green steel project shows, there could be many types involved in a single project.”

Record Year for (Corporate) Acquisitions

As the IPO window remains firmly closed and SPAC activity returns to pre-pandemic levels, acquisitions are gaining movement with corporate buyers. 2023 saw a historic high of 250 climate tech acquisitions, predominantly in the energy, transport, and food & agriculture sectors, the most notable of which was the acquisition of Canadian-based Carbon Engineering by U.S.-based Occidental Petroleum for $1.1B.

“On the heels of COP28 and the hottest year on record, we are seeing stakeholders come together like never before to meet today’s climate challenges with creative business strategies, collaborative financing approaches and branding and service delivery partnerships,” said Melanie Adamson, partner and CEO at Alder & Co., “2024 will be the year of collaborations.”

The State of Climate Tech 2023 report provides three essential breakdowns for data analysis and insight interpretation:

Product-Innovation Framework: This approach enhances the analysis of the climate tech investment landscape, providing valuable insights for specific investors and organizations to make informed decisions.

Venture Stage Breakdown: Aligned with the product-innovation framework, this breakdown offers innovators and investors the most relevant information tailored to their profiles and needs.

Capital Stack Breakdown: Encompassing equity, debt, and grants, this analysis offers a comprehensive understanding of the capital structure in the climate tech sector.

Some key insights derived from this approach include:

- Funding flowed toward adoption-focused innovations and later stages, indicating the increasing maturity in the market.

- Breakthrough solutions in the U.S. secured over twice the funding compared to Europe but median deal amount steadily increased in Europe across the framework.

- Government funding is assuming an ever-growing significance in shaping current climate tech dynamics, particularly fostering breakthrough innovations.

- Venture investors have a clear preference for digital solutions, funding them regardless of breakthrough or innovation.

Read the full report.

About Net Zero Insights

Net Zero Insights is the leading data and research platform for climate tech. The Net0 Platform provides access to thousands of startups/SMEs, deals, and investors allowing users to spot new innovations, trends and deals in the rapidly evolving world of climate technology. Investors, corporations, researchers and business developers use the platform to identify new startups and keep track of emerging trends and opportunities. Find out more: netzeroinsights.com

About Alder & Co

Alder & Co. is a leading, global strategic brand marketing agency with the mission to drive the adoption of climate technologies until they become universal. Alder partners with forward-facing, innovative climate tech companies that need progressive brand & marketing strategies to drive growth, secure investment, and make the impact needed to address our generation’s most urgent crisis – our environment. Find out more: alderagency.com

Media Contact

Whitney McGoram: [email protected]